- #Amortization mortgage calculator by payment amount how to

- #Amortization mortgage calculator by payment amount full

- #Amortization mortgage calculator by payment amount plus

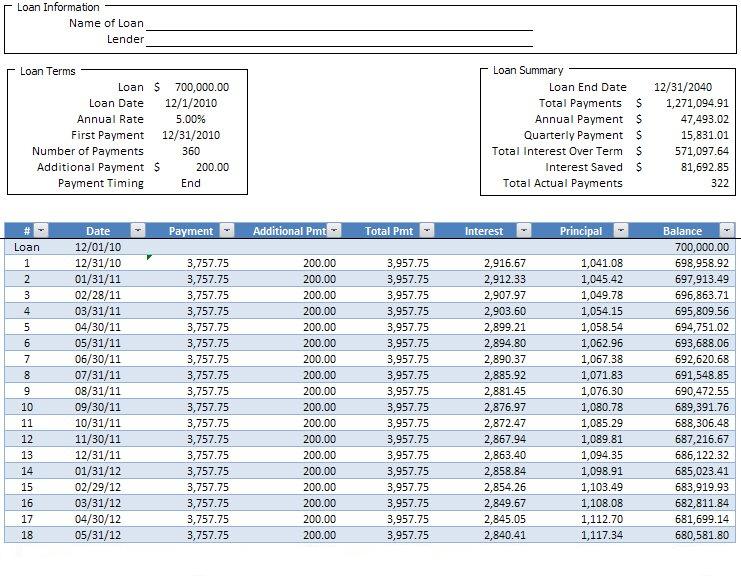

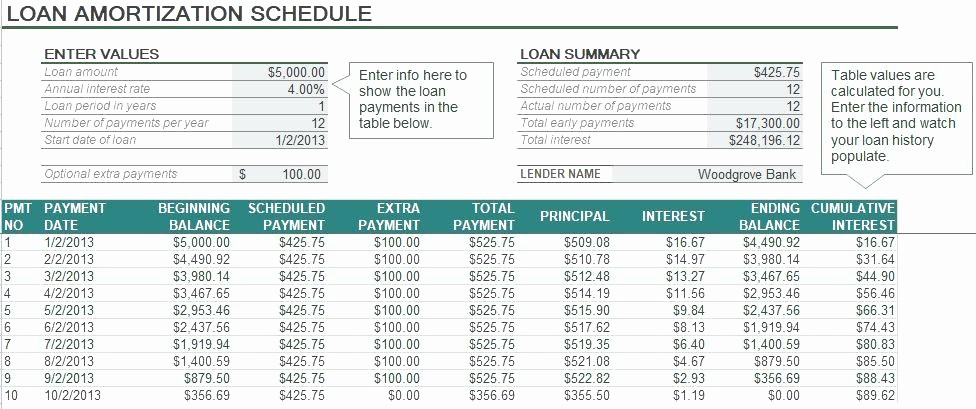

(payment = principal + interest) Monthly Extra the extra amount you plan to add to your monthly payments on this loan to be applied to principal You can likely look at your last statement to find the amounts applied to principal and interest and add these 2 numbers together. Current Monthly Loan Payment the amount currently to be paid on this loan on a monthly basis toward principal and interest only. Make Extra Payments Calculate how much your loan term and interest will change by applying extra money to your payments each month Reduce Term (Months) Calculate how much extra you need to pay each month in order to pay off your loan early Current Loan Balance the original amount on a new loan or principal outstanding if you are calculating a current loan Interest Rate the annual interest rate (stated rate) on the loan Remaining Term (Months) number of months which coincides with the number of payments to repay the loan. Create amortization schedules for the new term and payments. Try different loan scenarios for affordability or payoff. This amount also assumes that all payments are made as scheduled and no prepayments are made on the principal amount of the loan.Use this calculator to determine 1) how extra payments can change the term of your loan or 2) how much additional you must pay each month if you want to reduce your loan term by a certain amount of time in months. Total Payments – The total amount of all payments on this loan amount, including all interest and principal payments.

#Amortization mortgage calculator by payment amount full

Total Interest Paid – This is the full amount of interest you’ll pay on this loan as long as you make all your payments on time, as scheduled, and you don’t prepay any of the principal payments (like with a down payment on a vehicle). Note: if you play with the numbers, you’ll see that bi-weekly or weekly payments will pay off your loan more quickly than monthly payments. The options you can choose are a monthly payment (12 payments per year), bi-weekly (26 payments each year), or weekly (52 payments every year). Payment Frequency – You select how often payments are made. This could be a weekly or monthly payment, depending on what the amortization schedule determines. Number of Payments – The number of times you’ll need to make loan payments on this loan. The interest is calculated for each period (every month, every two weeks, or weekly depending on the payment frequency you’ve chosen) on the remaining balance of the loan. Interest Rate – The annual interest rate for this personal loan. Payment – The amount of money you have to pay each month (or every week or every two weeks depending on the payment frequency you choose) to pay off the loan. In this way, the amortization term, which is the actual. This would not include the amount of interest you would be paying based on your interest rate. It is important to note that in some particular cases, you may pay off the principal amount faster.

Loan Amount – Total amount of money you’re looking at borrowing. You can print the amortization schedule to keep track of your payments as you work at paying down your debt.ĭefinitions of Calculator’s Financial Terms The payment / amortization table also shows you what your loan balance will be after each payment. It will also generate a payment schedule or amortization table for the loan so you can see how much of each payment goes toward repayment of the the loan’s principal and how much goes to paying interest. Once you’ve entered all your loan details, click on “View Report” (at the very top of the calculator window) and you can see the amount of interest that you will pay over the life of the loan.

#Amortization mortgage calculator by payment amount plus

Below that, if you click the plus sign in the bottom right hand corner of the graph window, you’ll see a bar graph that shows the amount of each of your payments that goes to pay off your loan (the dark blue lines labeled “principal”) and the amount of each payment that goes to paying the interest on the loan (the light blue lines). Once you enter some numbers into this online calculator, it will show you your loan balance on a chart as a declining dark blue graph (the balance is of course declining as you slowly pay it off). Press the “View Report” button to see a payment schedule. You can select multiple durations at the same time to compare current rates and monthly payment amounts.

See your principal balances by payment, total of all payments made, and total interest paid. Alternate loan durations can be selected and results can be filtered using the Filter Results button in the bottom left corner. You can also enter in the payment and it’ll calculate your loan amortization amount.

#Amortization mortgage calculator by payment amount how to

How to Use This Canadian Personal Loan Payment Amortization CalculatorĮnter your desired payment and number of payments, select a payment frequency of Weekly, Bi-weekly or Monthly Payments, and the calculator will show your payment for your amortized loan.

0 kommentar(er)

0 kommentar(er)